georgia ad valorem tax 2021

TAVT Annual Ad Valorem Specialty License Plates. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate.

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

Make sure you get your childs 3600 child tax credit line 28 as well as the 1400 EIP3 payment line 30 if you had a child in 2021.

. This tax is based on the cars value and is the amount that can be entered on Federal Schedule A Form 1040 Itemized Deductions for an itemized deduction if the return qualifies to itemize deductions rather than take the standard deduction. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad Valorem Tax TAVT and are exempt from sales and use tax and the annual ad valorem tax.

Payment of the TAVT provides an exemption from sales tax on the motor vehicle and the purchaser will also be exempt from the annual ad valorem tax or. For the answer to this question we consulted the Georgia Department of Revenue. 18 title fee and 10 fees for late registration.

Certain exhibition ticket sales exempt from sales tax from July 2021 December 2022. Title Ad Valorem Tax Estimator calculator Get the estimated. Do I have to pay the Georgia ad valorem tax on a leased vehicle.

Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie. DEKALB TAD - 1 KEN04 T104.

Ad Valorem Tax on Vehicles. 1392 MB 2021 Motor Vehicle Assessment Manual for TAVT 1356 MB 2020 Motor Vehicle. GDVS personnel will assist veterans in obtaining the necessary documentation for filing.

Vehicles subject to TAVT are exempt from sales tax. The two changes that apply to most vehicle transactions are. 2021 Motor Vehicle Assessment Manual for TAVT 1356 MB 2020 Motor Vehicle Assessment Manual for TAVT 1363 MB 2019 Motor Vehicle Assessment Manual for TAVT 108 MB 2018 Motor Vehicle Assessment Manual for TAVT.

Tax amounts vary according to the current fair market value of the vehicle and the tax district in which the owner resides. What county in Georgia has the cheapest sales tax. Mar 26 2021 1033 AM.

These policy bulletins outline the annual interest rates regarding refunds and past due taxes in the State of Georgia for certain tax years. Georgia Motor Vehicle Assessment Manual for Title Ad Valorem Tax. Georgia law requires each county levying and recommending authority to provide certain disclosures to taxpayers prior to the establishment of the annual millage rate for ad valorem tax purposes.

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. Instead the purchased vehicles are subject to a one-time title ad valorem tax TAVT. And a timely Order can be issued by Commissioner authorizing the billing and collection of ad valorem taxes.

Taxes must be paid by the last day of your registration period birthday to avoid a 10 penalty. Georgia ad valorem tax rv NFTs and more on a platform you can trust. The actual filing of documents is the veterans responsibility.

PTS-R006-OD2020 Georgia County Ad Valorem Tax Digest Millage RatesPage 13 of 43. This tax is based on the value of the vehicle. The IRS didnt know about your future child obviously so it was not included in any EIP stimmy checks or if they deposited some of child tax credit into your bank in the second half of 2021.

Georgia Tax Center Help Individual Income Taxes Register New Business. Under Cars and Other Things You Own- Show more and Start or Revisit Car Registration Fees. County District MO Bond.

Of Revenue has updated its guidance on the sales and use tax exemption for admission to certain performances and exhibitions to reflect recently enacted legislation. Ad valorem taxes are due each year on all vehicles whether they are operational or not even if the tag or registration renewal is not being applied for. The mailing address for payments is 6200 Fairburn Road Douglasville GA 30134 and a drop is located in the parking lot of this location.

Georgia has recent rate changes Thu Jul 01. March 17 2021 513 PM. Annual Notice of Interest Rate Adjustment 8577 KB ADMIN 2021-01 - Annual Notice of Interest Rate Adjustment 8564 KB ADMIN 2020-01 - Annual.

To enter your Personal Property Taxes take the following steps. The tax must be paid at the time of sale by Georgia residents or within six months of. Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia.

If itemized deductions are also. The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties. Local state and federal government websites often end in gov.

GEORGIA DEPARTMENT OF REVENUE. In the most recent legislative session the Georgia General Assembly passed Senate Bill 65 which made several changes to the title ad valorem tax TAVT code sections which apply to vehicles purchased or sold on or after January 1 2020. The Georgia Annual Ad Valorem Tax applies to most vehicles purchased prior to March 1 2013 and non-titled vehicles and qualifies as a Personal Property Tax.

Georgia SB631 2021-2022 A BILL to be entitled an Act to amend an Act to grant to residents of Clarke County and the Clarke County School District upon their homesteads an exemption of 1000000 from certain ad valorem taxes levied by the Unified Government of AthensClarke County Georgia and levied by for or on behalf of the Clarke County School District approved April 13. DEKALB STONE MOUNTAIN 21000. The 90 varies by age 50 year prior 90 current model year 60 second year 40 third year 25 fourth y.

The tax must be paid at the time of sale by Georgia residents or within six months of. TAVT Annual Ad Valorem Specialty License Plates Dealers Insurance Customer Service Operations. Does GA still charge ad valorem tax.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles. The TAVT rate will be lowered to 66 of the fair market value.

The Annual Ad Valorem Tax is imposed on vehicles that have not been taxed under the Title Ad Valorem Tax in Georgia. 2021 - 500 Individual Income Tax Return 2021 - 500 Individual Income Tax Return Complete the 2021 - 500 Individual Income Tax Return Online. Title Ad Valorem Tax TAVT - FAQ.

Get the estimated TAVT tax based on the value of the vehicle using. DEKALB TAD - 1 KEN14 T114. Title Ad Valorem Tax TAVT Currently TAVT is 66 of the retail value assessed value established by the Georgia Department of Revenue or clean retail value shown by the NADA.

The Annual Ad Valorem Tax is determined on an annual basis and is required to. 4500 plus ad valorem taxif applicable. Updated April 6 2021.

Pin By Bobbie Persky Realtor On Finance Real Estate Tax Attorney Property Tax Tax Lawyer

304 Burgess Walk Alpharetta Ga 30009 Alpharetta The Neighbourhood Club House

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Tax Rates Gordon County Government

Georgia Revenue Primer For State Fiscal Year 2021 Georgia Budget And Policy Institute

Money Matters Buying A Home Teresa S Step By Step Basics In 2021 Home Buying Money Matters Second Mortgage

2612 Horsley Mill Rd Carrollton Ga 30116 Mls 8995639 Coldwell Banker In 2021 Carrollton Coldwell Banker Real Estate Services

Tax Rates Gordon County Government

542 Henry Higgins Rd Jackson Ga 30233 3645 Lhrmls 00873684 Lakehomes Com In 2021 Waterfront Property Real Estate Houses Vinyl Exterior

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

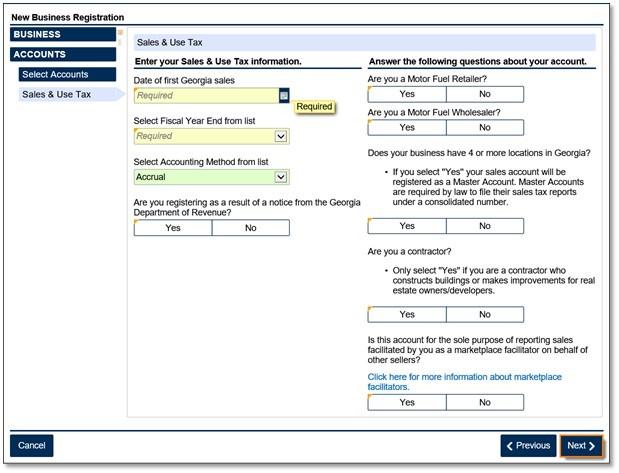

Marketplace Facilitators Georgia Department Of Revenue

Pin By Melissa Shortt On Aveda Oconee Embarcadero Aveda

Property Taxes Laurens County Ga

Retirement Taxes By State 2021 Retirement Benefits Retirement Paying Taxes